Learning Center

We keep you up-to-date on the latest tax changes and news in the industry.

5 Things You Should Do Every Time You Open QuickBooks

Usually when people talk about habits, they’re trying to find ways to break bad ones. Sometimes it’s difficult to even trace them back to how they got started. They’ve just become habits.

Starting new ones should be easier than breaking old, established ones. And when it comes to your knowledge about your company’s financial health, it’s good to develop practices that you eventually do without even thinking about them.

QuickBooks offers many ways to:

Get a quick overview of what’s happening with your money,

Drill down on the details, and

Take positive actions.

Here’s what we suggest you do every time you start a work session in QuickBooks.

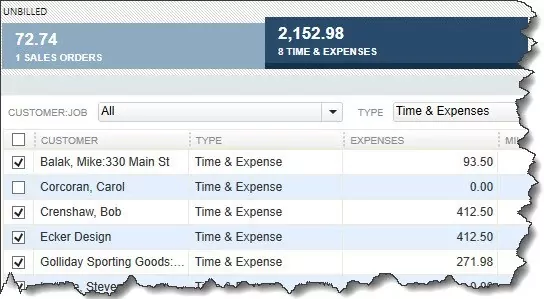

Open the Income Tracker.

Go to Customers | Income Tracker. This is the best way to get a quick look at your receivables status. Colored bars across the top of the page show the number of transactions and dollar totals for Unbilled Sales Orders, Unbilled Time & Expenses, Unpaid Open Invoices and Overdue Invoices, and the Amount Paid Last 30 Days. Click any of the bars, and the list below displays only those transactions.

QuickBooks’ Income Tracker can tell you quickly about the status of your receivables.

Click the down arrow under Action at the end of each row, and you can complete related tasks like Create Invoice, Receive Payment, and Email Row. You can also do Batch Actions like Invoice and Batch Email. And you can create new transactions from here.

Look at your Snapshots.

You may have already developed a routine for your QuickBooks minutes and hours. You might send a few invoices and pay a few bills and record payments that have come in since you last session. Those are the things you know about. But what about the hidden tasks and potential problems that you don’t? You might be able to prevent trouble down the road by anticipating it.

QuickBooks’ Snapshots are a good place to start. There are three of them: Company, Payments, and Customer (Company | Company Snapshot). Take a good look at the charts and tables in the first two especially. You can learn a lot in a short period of time.

Check your inventory levels.

You certainly don’t instill faith in your customers by running out of items that you’ve said are available. If you don’t keep a close watch on your inventory levels, you risk:

Incurring extra costs to have items shipped to you quickly if you’re a reseller.

Having to drop everything and create new products if you sell one-of-a-kind items, and/or

Losing customers because you can’t fulfill orders rapidly.

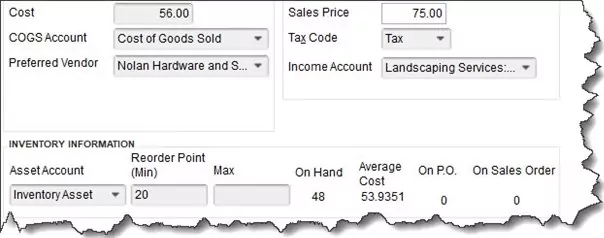

One of the things you should be consulting every time you open QuickBooks (if you sell products) is the Inventory Stock Status by Item report. Go to Reports | Inventory to find it. Look at the Reorder Pt (Min) and Available columns. You don’t have to wait until you hit the reorder point. Try to anticipate shortages when products are selling rapidly, and change the Reorder Pt if necessary.

You can set and edit your own Reorder Point when you create an inventory item in QuickBooks.

Check Your Payments to Deposit

Often, funds received from invoice payments and sales receipts go into the Undeposited Funds account. To see this account, go to Company | Chart of Accounts | Undeposited Funds. You should be checking occasionally to see if there is money that needs to be deposited. On the home page, under Banking in the lower right corner, click Record Deposits. QuickBooks will display a list of payments received that haven’t yet been deposited in your bank account.

Click in the Select Payment to Deposit column in front of payments you want to deposit. Click OK. Select the correct Deposit to account in the upper left. If you want cash back from this deposit, indicate that in the fields in the lower left. Add a Memo if you’d like and confirm the Date. When you’re done, save the deposit record. Now you can create a physical deposit slip and take it and the checks and/or cash to the bank.

Look at Bill Tracker

If you’re tracking you bills in QuickBooks’ Bill Tracker (and we recommend this), you can learn quickly if you have any outstanding bills or any that are coming due soon. Go to Vendors | Bill Tracker. This works just like the Income Tracker. Colored bars at the top of the screen divide your bills into:

Unbilled purchase orders,

Unpaid open bills,

Unpaid overdue bills, and

Bills paid in the last 30 days.

Check the Due Date column to see where you stand with payables. Options in the Action column include Convert to Bill, Close PO, and Pay Bill.

Make It Second Nature

It may take you some time at first to run through all of these steps. But if you make it a habit, it will start to come naturally – and quickly. There are, of course, additional ways to get a handle on your finances, but if you consult these screens regularly, you’ll have a good idea of actions you need to take and potential problems looming. Remember: We’re here and available to hear about your QuickBooks concerns. If you’re new to the software, we can even provide training for you. Just contact us.

Want our best tax and accounting tips and insights delivered to your inbox?

Sign up for our newsletter.

Benefits of having a business advisor

Your CFO, Reimagined as a Financial Doctor

Diagnosing root causes, prescribing solutions, and guiding your property business toward long-term wealth.

Our CFO | Advisor

Raquel is a passionate business owner. Now, she is returning to her grassroots with a twist - guiding clients with her expertise as a CPA, she can advise your company as your trusted CFO and Advisor.

-

Raquel Deodanes, MS, CPA

Co-Founder✅ CPA with Real-World Experience – I help property managers stay profitable, tax-efficient, and cash flow positive.

✅ Tax Strategist – Former advisor at California’s revenue agency.

✅ Trusted by 4,000+ Businesses – Experience across CA, FL, TX, NV, and beyond.

✅ Real Estate Investor – I understand the financial realities of property management.

✅ Entrepreneur – I’ve built businesses and know the challenges you face.

Frequently Asked Questions

-

We diagnose financial inefficiencies, treat problems like poor cash flow or rising costs, and guide you to long-term financial health. That includes cleaning up your books, forecasting cash flow, optimizing operations, and helping you grow your portfolio with confidence — just like a doctor builds a custom care plan for a patient.

-

Bookkeepers record transactions. CPAs file your taxes. We connect the dots — helping you understand your numbers, strategically improve them, and make smarter decisions throughout the year. We work alongside your existing team to drive performance, not just compliance.

-

If you're unsure where your cash is going, struggling with rising costs, planning to scale, or just tired of reacting instead of planning — now is the right time. We help you get ahead of problems, not just clean up after them.

-

Clients typically see improved cash flow, cleaner books, higher NOI, better financial reporting, and a lot less stress at tax time. More importantly, you gain clarity, confidence, and control over your business — and a partner who helps you grow it.

Pricing

Painless, transparent pricing.

Let us take away your stress and give you back your time. Choose your perfect package today.

Base

-

Dedicated finance expert

-

Bookkeeping with accrual basis

-

Includes P&L, balance sheet, and cash flow statements

Core

-

Includes everything in Base, PLUS

-

Industry KPIs and financial ratios

-

Monthly virtual 1-hr meetings

-

Monthly rolling budget forecasts

Growth

-

Includes everything in Base, CORE

-

Budget vs. actuals variance analysis and review

-

Payroll and HR Platform