Learning Center

We keep you up-to-date on the latest tax changes and news in the industry.

Effortless Financial Management: Mastering QuickBooks Online's Recurring Transactions

Since we're still in the early weeks of 2024, now is the perfect time to improve your business operations with QuickBooks for a more efficient and prosperous year ahead. QuickBooks Online continues to provide a wide array of bookkeeping and accounting features to simplify financial management tasks, particularly for small business owners. One notable feature is the capability to set up recurring transactions, a powerful tool that can save time and automate certain expenses.

Whether you prefer QuickBooks Online or QuickBooks Desktop, integrating recurring transactions into your financial processes can significantly streamline day-to-day operations. Here, we look at the strategies you can use to optimize recurring transactions specifically within the QuickBooks Online system.

Mastering Recurring Transactions In QuickBooks Online

For businesses with regular monthly expenses (excluding bills), QuickBooks Online's recurring transactions feature can be an incredibly useful tool. By establishing recurring templates for specific costs, business owners can automate processes, ensuring timely payments. This feature is particularly beneficial for businesses with subscription-based revenue models, allowing effortless creation of recurring invoices, thereby saving time and preventing delays in subscriber payments.

Creating Recurring Templates

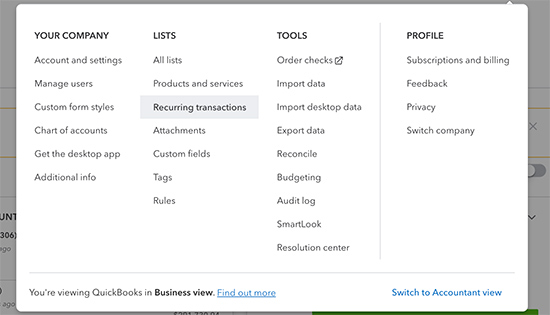

Access Your Settings: Log in to your QuickBooks Online account and go to the Settings ⚙ menu.

Select Recurring Transactions: In the Settings menu, find and select "Recurring Transactions."

Create a New Template: Click on "New" to create a new recurring template.

Choose Transaction Type: Select the transaction type you want to make recurring (excluding bill payments and time activities). Click "OK."

Name Your Template: Give your template a descriptive name for easy identification.

Specify the Type: Choose the template type – Scheduled, Unscheduled, or Reminder – depending on the transaction nature and recurrence frequency.

Complete the Template: Fill in all necessary fields, including payee or customer details, items or services involved, and any relevant information.

Save the Template: Once the template is completed, save it. Your recurring transaction is now set up, automating your financial processes.

Duplicating Existing Templates

QuickBooks Online also facilitates an expedited template creation process by allowing users to duplicate existing templates. Here's how:

Access Settings: Again, navigate to the Settings ⚙ menu.

Select Recurring Transactions: Click on "Recurring Transactions."

Choose a Template: Select the one you want to duplicate from your list of recurring templates.

Duplicate the Template: In the Action column dropdown menu, choose "Duplicate." The duplicate will inherit all settings from the original template, except for the title.

Edit as Needed: Customize the duplicated template by editing fields, making adjustments, or adding new details.

Save the Duplicate: Save your duplicated template, and it's ready for use.

Recurring transactions in QuickBooks Online simplify financial management tasks for business owners in all industries. By automating routine transactions and reducing manual data entry, you'll save valuable time and minimize the risk of errors in your financial records. When it comes to managing business accounting, QuickBooks' recurring transactions feature is a valuable tool contributing to overall efficiency.

Want our best tax and accounting tips and insights delivered to your inbox?

Sign up for our newsletter.

Benefits of having a business advisor

Your CFO, Reimagined as a Financial Doctor

Diagnosing root causes, prescribing solutions, and guiding your property business toward long-term wealth.

Our CFO | Advisor

Raquel is a passionate business owner. Now, she is returning to her grassroots with a twist - guiding clients with her expertise as a CPA, she can advise your company as your trusted CFO and Advisor.

-

Raquel Deodanes, MS, CPA

Co-Founder✅ CPA with Real-World Experience – I help property managers stay profitable, tax-efficient, and cash flow positive.

✅ Tax Strategist – Former advisor at California’s revenue agency.

✅ Trusted by 4,000+ Businesses – Experience across CA, FL, TX, NV, and beyond.

✅ Real Estate Investor – I understand the financial realities of property management.

✅ Entrepreneur – I’ve built businesses and know the challenges you face.

Frequently Asked Questions

-

We diagnose financial inefficiencies, treat problems like poor cash flow or rising costs, and guide you to long-term financial health. That includes cleaning up your books, forecasting cash flow, optimizing operations, and helping you grow your portfolio with confidence — just like a doctor builds a custom care plan for a patient.

-

Bookkeepers record transactions. CPAs file your taxes. We connect the dots — helping you understand your numbers, strategically improve them, and make smarter decisions throughout the year. We work alongside your existing team to drive performance, not just compliance.

-

If you're unsure where your cash is going, struggling with rising costs, planning to scale, or just tired of reacting instead of planning — now is the right time. We help you get ahead of problems, not just clean up after them.

-

Clients typically see improved cash flow, cleaner books, higher NOI, better financial reporting, and a lot less stress at tax time. More importantly, you gain clarity, confidence, and control over your business — and a partner who helps you grow it.

Pricing

Painless, transparent pricing.

Let us take away your stress and give you back your time. Choose your perfect package today.

Base

-

Dedicated finance expert

-

Bookkeeping with accrual basis

-

Includes P&L, balance sheet, and cash flow statements

Core

-

Includes everything in Base, PLUS

-

Industry KPIs and financial ratios

-

Monthly virtual 1-hr meetings

-

Monthly rolling budget forecasts

Growth

-

Includes everything in Base, CORE

-

Budget vs. actuals variance analysis and review

-

Payroll and HR Platform