Learning Center

We keep you up-to-date on the latest tax changes and news in the industry.

Freshen Your Finances: QuickBooks Spring Cleaning Tips

As the season changes and springtime approaches, it’s not just your home that could use a good cleaning. Your financial records, especially in QuickBooks, could benefit from a little spring cleaning too. With tax season in full swing and the start of a new fiscal year for many businesses, now is the perfect time to tidy up your QuickBooks account. Here are some QuickBooks spring cleaning tips to help you freshen your finances:

Review and reconcile accounts: Start by reviewing your accounts and reconciling them to ensure that your records match your bank and credit card statements. Look for any discrepancies or errors that need to be corrected.

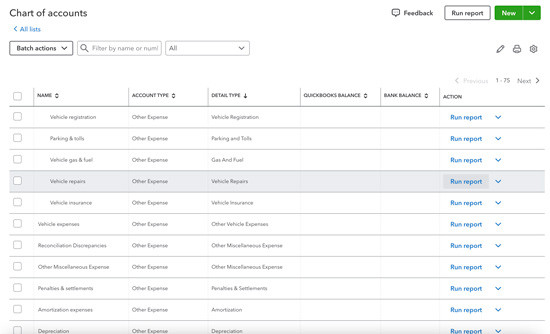

Clean up your chart of accounts: Take some time to review your chart of accounts and clean up any accounts that are no longer needed or relevant. This can help streamline your financial reporting and make it easier to track your income and expenses.

Archive old transactions: Consider archiving old transactions to keep your QuickBooks file size manageable. This can help improve performance and make it easier to navigate your data.

Update vendor and customer information: Review and update vendor and customer information to ensure that it is accurate and current. This can help prevent any communication or payment issues in the future.

Reclassify transactions: Go through your transactions and reclassify any that may have been categorized incorrectly. This way, your financial reports will be accurate and reliable when you need them to make business decisions.

Set up reminders and notifications: Take advantage of QuickBooks’ reminder and notification features to stay on top of important deadlines and tasks. This can help prevent any last-minute scrambling and ensure that you stay organized throughout the year.

Back up your data: Don’t forget to back up your QuickBooks data regularly to protect against data loss or corruption. Consider using cloud storage like Apple’s iCloud or Google Drive – or an external hard drive – for added security.

Evaluate and optimize workflows: Take some time to evaluate your current workflows and identify any areas that could be optimized or improved. This can help streamline your processes and make your accounting tasks more efficient.

Attend training or seek professional help: If you’re feeling overwhelmed or unsure about how to clean up your QuickBooks account, consider attending a training session or seeking help from a professional. QuickBooks offers a variety of resources and support options to help you get the most out of your small business accounting software.

Plan for the future: Finally, use this opportunity to plan for the future and set financial goals for the coming months. Whether it’s saving for a major purchase or preparing for tax season next year, having a clear plan in place can help set you up for success.

By following these QuickBooks spring cleaning tips, you can ensure that your financial records are accurate, up-to-date, and well-organized. Take advantage of the changing season to give your finances a fresh start and set yourself up for a successful rest of the year!

Want our best tax and accounting tips and insights delivered to your inbox?

Sign up for our newsletter.

Benefits of having a business advisor

Your CFO, Reimagined as a Financial Doctor

Diagnosing root causes, prescribing solutions, and guiding your property business toward long-term wealth.

Our CFO | Advisor

Raquel is a passionate business owner. Now, she is returning to her grassroots with a twist - guiding clients with her expertise as a CPA, she can advise your company as your trusted CFO and Advisor.

-

Raquel Deodanes, MS, CPA

Co-Founder✅ CPA with Real-World Experience – I help property managers stay profitable, tax-efficient, and cash flow positive.

✅ Tax Strategist – Former advisor at California’s revenue agency.

✅ Trusted by 4,000+ Businesses – Experience across CA, FL, TX, NV, and beyond.

✅ Real Estate Investor – I understand the financial realities of property management.

✅ Entrepreneur – I’ve built businesses and know the challenges you face.

Frequently Asked Questions

-

We diagnose financial inefficiencies, treat problems like poor cash flow or rising costs, and guide you to long-term financial health. That includes cleaning up your books, forecasting cash flow, optimizing operations, and helping you grow your portfolio with confidence — just like a doctor builds a custom care plan for a patient.

-

Bookkeepers record transactions. CPAs file your taxes. We connect the dots — helping you understand your numbers, strategically improve them, and make smarter decisions throughout the year. We work alongside your existing team to drive performance, not just compliance.

-

If you're unsure where your cash is going, struggling with rising costs, planning to scale, or just tired of reacting instead of planning — now is the right time. We help you get ahead of problems, not just clean up after them.

-

Clients typically see improved cash flow, cleaner books, higher NOI, better financial reporting, and a lot less stress at tax time. More importantly, you gain clarity, confidence, and control over your business — and a partner who helps you grow it.

Pricing

Painless, transparent pricing.

Let us take away your stress and give you back your time. Choose your perfect package today.

Base

-

Dedicated finance expert

-

Bookkeeping with accrual basis

-

Includes P&L, balance sheet, and cash flow statements

Core

-

Includes everything in Base, PLUS

-

Industry KPIs and financial ratios

-

Monthly virtual 1-hr meetings

-

Monthly rolling budget forecasts

Growth

-

Includes everything in Base, CORE

-

Budget vs. actuals variance analysis and review

-

Payroll and HR Platform