Learning Center

We keep you up-to-date on the latest tax changes and news in the industry.

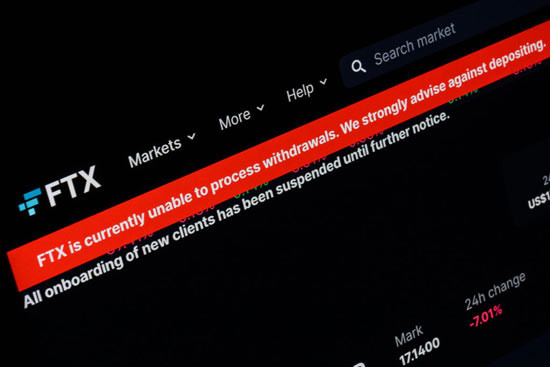

How the FTX Crypto Bankruptcy Was Born From a Complete Lack of Accounting Controls

FTX Group, also officially referred to as FTX Trading Ltd., is a cryptocurrency company that is currently in the process of bankruptcy proceedings. In addition to previously operating as a cryptocurrency exchange, it was also a crypto hedge fund.

It was originally founded in 2019 and hit its stride just a few years later in 2021. At one point, it had over a million users and was considered to be the third-largest exchange of its type in existence.

My, what a difference a few years can make.

Over the course of a relatively short period of time, FTX Group went from being worth an estimated $32 billion to filing for bankruptcy. The founder, Sam Bankman-Fried, became one of the wealthiest people on the planet by the age of 30 during this period. Having said that, things have gotten so bad that there has been a negative ripple effect across the entire crypto space.

Not only are more people than ever doubting the validity of crypto, but Congress and the Securities and Exchange Commission (SEC) are currently investigating exactly what happened.

Now, as new information is revealed on a regular basis, we're getting a better picture of how everything reached this point - and the details certainly aren't pretty.

FTX Group: The Story So Far

While this isn't the only reason that FTX Group finds itself in its current position, a major contributing factor seems to be the fact that the organization didn't have an in-house accounting department of any kind.

Not only is that bad in an over-arching sense, but it makes things particularly tricky once bankruptcy proceedings have begun. Presently, FTX Group is now struggling to obtain accurate financial statements to be used moving forward. Most of what they already have "cannot be trusted," according to experts.

All of this makes it particularly more distressing that Sam Bankman-Fried and FTX Group misused customer funds. The fact that they lack trustworthy financial statements of any kind makes the mess difficult, if not impossible, to truly untangle.

One professional overseeing the bankruptcy proceedings is a man named John Ray III. He's been an insolvency professional for decades and he actually oversaw the liquidation of Enron earlier in his career. In a filing with the court, he indicated that the current status of FTX Group is "the worst case of corporate failure" that he had seen in the more than four decades that he had been on the job.

The proverbial "straw that broke the camel's back" in terms of the FTX Fund collapse happened when Sam Bankman-Fried used in excess of $10 billion of client funds to support his own hedge fund, Alameda Research. That fund had recently suffered losses after making a series of bets on cryptocurrency-related ventures that never ended up paying off. When that occurred, FTX no longer had the funds it needed to cover withdrawals. One of the currencies that it was trading, FTT, triggered a bank run. At that point, the writing was on the wall.

All told, the accounting-related issues that FTX Group embraced was a long one. Not only did they fail to keep proper books and records, but there were also no security controls in place to safeguard the digital assets it was holding for customers. Not only that, but officials used software to "conceal the misuse of customer funds" - something that more than shows intent to defraud. All accounting functionality was being outsourced to the point where organizational leaders didn't even have a proper list of their own bank accounts. It has even been suggested that there was no official list of people who worked for the company in the first place.

In the end, it's important to acknowledge that none of this is meant to underline some inherent negative aspect of cryptocurrency necessarily. As a form of currency, it can and does have a lot of potential when deployed properly. It's just that, as is often true in most industries, its success as a concept depends on the ability of the people at the forefront to do the right thing and to act with integrity.

Credit: Leon Neal / Getty Images News via Getty Images

In the case of FTX Group, that decidedly did not happen.

Now, cryptocurrency markets are in a plunge and consumer confidence is shattered. The extent of the long-term ramifications of these events remains to be seen, as things are largely still unfolding. But one thing is for sure - a general lack of accounting best practices, little in the way of control, and overall reckless behavior contributed to the type of meltdown that financial professionals will be studying for years to come.

Want our best tax and accounting tips and insights delivered to your inbox?

Sign up for our newsletter.

Benefits of having a business advisor

Your CFO, Reimagined as a Financial Doctor

Diagnosing root causes, prescribing solutions, and guiding your property business toward long-term wealth.

Our CFO | Advisor

Raquel is a passionate business owner. Now, she is returning to her grassroots with a twist - guiding clients with her expertise as a CPA, she can advise your company as your trusted CFO and Advisor.

-

Raquel Deodanes, MS, CPA

Co-Founder✅ CPA with Real-World Experience – I help property managers stay profitable, tax-efficient, and cash flow positive.

✅ Tax Strategist – Former advisor at California’s revenue agency.

✅ Trusted by 4,000+ Businesses – Experience across CA, FL, TX, NV, and beyond.

✅ Real Estate Investor – I understand the financial realities of property management.

✅ Entrepreneur – I’ve built businesses and know the challenges you face.

Frequently Asked Questions

-

We diagnose financial inefficiencies, treat problems like poor cash flow or rising costs, and guide you to long-term financial health. That includes cleaning up your books, forecasting cash flow, optimizing operations, and helping you grow your portfolio with confidence — just like a doctor builds a custom care plan for a patient.

-

Bookkeepers record transactions. CPAs file your taxes. We connect the dots — helping you understand your numbers, strategically improve them, and make smarter decisions throughout the year. We work alongside your existing team to drive performance, not just compliance.

-

If you're unsure where your cash is going, struggling with rising costs, planning to scale, or just tired of reacting instead of planning — now is the right time. We help you get ahead of problems, not just clean up after them.

-

Clients typically see improved cash flow, cleaner books, higher NOI, better financial reporting, and a lot less stress at tax time. More importantly, you gain clarity, confidence, and control over your business — and a partner who helps you grow it.

Pricing

Painless, transparent pricing.

Let us take away your stress and give you back your time. Choose your perfect package today.

Base

-

Dedicated finance expert

-

Bookkeeping with accrual basis

-

Includes P&L, balance sheet, and cash flow statements

Core

-

Includes everything in Base, PLUS

-

Industry KPIs and financial ratios

-

Monthly virtual 1-hr meetings

-

Monthly rolling budget forecasts

Growth

-

Includes everything in Base, CORE

-

Budget vs. actuals variance analysis and review

-

Payroll and HR Platform