Learning Center

We keep you up-to-date on the latest tax changes and news in the industry.

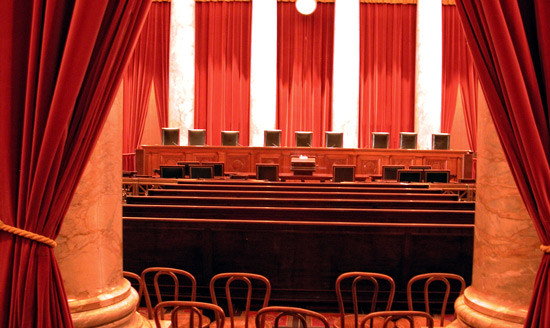

Supreme Court Showdown: The Fate of American Wealth Taxes

Some politicians’ dreams of imposing a wealth tax on the richest Americans face a critical juncture as the United States Supreme Court prepares to weigh in on a seemingly minor tax dispute involving a $14,729 tax liability. The case, known as Moore v. United States, challenges a provision of President Donald Trump's 2017 tax package – and it could have far-reaching implications for the nation's tax system.

Calls for a wealth tax gained momentum following Senator Elizabeth Warren's 2020 presidential campaign and found echoes in President Joe Biden's 2024 budget, which proposed a "billionaire minimum tax." However, the fate of these proposals now rests on the Supreme Court's deliberation on the constitutionality of taxing stock holdings, real estate, and other forms of wealth.

Kevin Dietsch/Getty Images News via Getty Images

At the center of the case are Charles and Kathleen Moore from Washington State. The couple is challenging a one-time levy on offshore earnings. However, questions about the accuracy of their presented personal story have surfaced, raising concerns about the foundation of their constitutional challenge. Charles Moore's five-year tenure on the board of KisanKraft – the company central to the case – along with a significant cash contribution, brings into question the legitimacy of their challenge.

Legal experts, including University of Florida tax policy specialist Mindy Herzfeld, who spoke to The Washington Post, caution against deciding constitutional matters based on potentially inaccurate facts, emphasizing the potential risks to the Court's credibility.

Herzefeld said making a decision based on dubious information “risks undermining the Court’s legitimacy and creating the impression that its docket and its decisions are too easily manipulated by politically motivated interest groups.”

SCOTUS justices are now tasked with determining whether the tax on offshore earnings, a part of Trump's 2017 tax cut, aligns with Congress's limited powers of taxation granted by the Constitution. Advocates fear that a ruling against this provision could set a precedent, blocking future attempts by Congress to impose taxes, including the aforementioned wealth tax championed by longtime Senator Elizabeth Warren.

The case has garnered support from an unusual coalition, with both the Biden administration and conservatives like former House speaker Paul D. Ryan defending the offshore-earnings tax. Their concern lies not in endorsing a wealth tax but in preventing potential upheaval of existing taxes on investments, partnerships, and foreign income.

The Supreme Court's decision could have profound consequences, potentially affecting a wide range of taxes. The Moore’s’ challenge revolves around IRS tax code Section 965, a provision that is forecasted to raise over $300 billion in a decade, with implications reaching into areas like partnership earnings. In theory, this could cost the government over $3 trillion in the next 10 years, according to the Tax Foundation.

As the Supreme Court prepares to hear this landmark case on December 5, the future of wealth taxes and the stability of the nation's tax system hang in the balance. The decision may not only shape the immediate tax landscape but could reverberate across various aspects of financial policy, influencing the ongoing debate on wealth inequality in the United States.

Want our best tax and accounting tips and insights delivered to your inbox?

Sign up for our newsletter.

Benefits of having a business advisor

Your CFO, Reimagined as a Financial Doctor

Diagnosing root causes, prescribing solutions, and guiding your property business toward long-term wealth.

Our CFO | Advisor

Raquel is a passionate business owner. Now, she is returning to her grassroots with a twist - guiding clients with her expertise as a CPA, she can advise your company as your trusted CFO and Advisor.

-

Raquel Deodanes, MS, CPA

Co-Founder✅ CPA with Real-World Experience – I help property managers stay profitable, tax-efficient, and cash flow positive.

✅ Tax Strategist – Former advisor at California’s revenue agency.

✅ Trusted by 4,000+ Businesses – Experience across CA, FL, TX, NV, and beyond.

✅ Real Estate Investor – I understand the financial realities of property management.

✅ Entrepreneur – I’ve built businesses and know the challenges you face.

Frequently Asked Questions

-

We diagnose financial inefficiencies, treat problems like poor cash flow or rising costs, and guide you to long-term financial health. That includes cleaning up your books, forecasting cash flow, optimizing operations, and helping you grow your portfolio with confidence — just like a doctor builds a custom care plan for a patient.

-

Bookkeepers record transactions. CPAs file your taxes. We connect the dots — helping you understand your numbers, strategically improve them, and make smarter decisions throughout the year. We work alongside your existing team to drive performance, not just compliance.

-

If you're unsure where your cash is going, struggling with rising costs, planning to scale, or just tired of reacting instead of planning — now is the right time. We help you get ahead of problems, not just clean up after them.

-

Clients typically see improved cash flow, cleaner books, higher NOI, better financial reporting, and a lot less stress at tax time. More importantly, you gain clarity, confidence, and control over your business — and a partner who helps you grow it.

Pricing

Painless, transparent pricing.

Let us take away your stress and give you back your time. Choose your perfect package today.

Base

-

Dedicated finance expert

-

Bookkeeping with accrual basis

-

Includes P&L, balance sheet, and cash flow statements

Core

-

Includes everything in Base, PLUS

-

Industry KPIs and financial ratios

-

Monthly virtual 1-hr meetings

-

Monthly rolling budget forecasts

Growth

-

Includes everything in Base, CORE

-

Budget vs. actuals variance analysis and review

-

Payroll and HR Platform